Who We Are

Bent Nail Properties Ltd would like to present a significant business proposition with purpose and excitement like no other. We are developing a 40-unit housing complex, with a fitness and office park in Lusaka, the capital city of Zambia. This high-end development is designed to belong to the high-end sector of the Lusaka rental market. The investment will touch Zambian lives and communities by providing employment opportunities during the construction phase and beyond and providing a primary source of sustainable funding for Christian Missions in Zambia; it will also provide the investors with the potential for superior financial returns. We invite you to read through this prospectus and contact us for any additional information.

This investment opportunity gives the investor the chance to be part of transforming lives in Zambia indefinitely. PDH Foundation will be awarded at least 20% of the income from this project, with the ultimate goal of eventually owning the whole enterprise. This enables PDH Foundation to count on a stable sustainable income stream as it continues to serve the people of Zambia. More about this later.

PDH Foundation is an organization that is 100% dedicated to the fulfillment of the Great Commission that Jesus Christ commanded just before He ascended to Heaven leaving His disciples with the promise of the coming of the Holy Spirit. PDH Foundation exists for the sole purpose of seeing God’s Kingdom advance through the sustainable multiplication of life-changing missions. We believe God has called us to join His Kingdom Business by using our talents as builders, architects, engineers, and business people to generate and deploy capital in support of Christian missions across Zambia in the immediate future and ultimately expand the concept to other African countries. As members of the Body of Christ, we strive to fulfill our function in three strategic areas in obedience to that commission:

A. Restoration of a sense of dignity among Zambian nationals now (and ultimately expanding to other parts of Africa). Sustainable change requires a holistic approach. The jobs created in this process will provide the job holders a means to provide for their families, restoring a sense of dignity. The concurrent skill acquisition makes them more marketable, providing HOPE and SECURITY for the future. The spiritual development they experience in this process compels them to share the love of Christ with others, ensuring transformation. By empowering individuals both spiritually and economically, God can use them to transform their own lives as well as their families and communities.

B. Transformation of Zambian Christian mission organizations into self-sustaining Christian mission organizations. Our passion is to see missionaries sustained predominantly through ongoing income sources generated from real estate development projects – making it possible for missionaries to focus more on their calling and less on raising money to sustain their activities. We commit to creating capital to support the members of the Body who are called to traditional missions.

C. Serving as responsible stewards for the resources entrusted to it by donors and supporters who use PDH as a conduit that connects their support to the work of PDH and the greater work in the vineyard of God’s Kingdom.

The Vision

The vision of PDH is the “picture” of the world that one can see in the mind’s eye if and when PDH has accomplished its purpose. PDH has a three-faceted vision, with each facet representing the picture of success envisioned for each class of stakeholder:

A. Every Zambian national who interacts with PDH is growing in the restoration of his/her sense of dignity.

B. Every Christian mission in Zambia now, and in other parts of Africa later, which is supported by PDH is on a path towards a self-sustaining existence.

C. Donors and supporters of PDH find it to be a fully transparent and accountable steward of all resources entrusted to it.

The Mission

The mission of PDH is the actual work that PDH does in order to realize its vision. Once again, the work comes in three varieties, one for each class of stakeholder:

A. Afford individuals a variety of means of support and encouragement, in accordance with operating guidelines adopted by PDH, including but not limited to granting educational and training scholarships, providing financial assistance to qualifying individuals and families, granting financing assistance for individuals setting up individual proprietary (small) businesses, and facilitating the provision of intervention services for individuals who find themselves in crisis situations.

B. PDH cooperates with existing Christian Missions in defining, planning for, funding, and implementing income-generating business ventures which exist for the dual purpose of

(a) Operating a sound business that observes Christian principles in the conduct of the business.

(b) Dedicating at least 1/3 of its net income to support the client’s mission.

C. Donors and supporters of PDH have found that it consistently operates in a fully sound and transparent manner, including but not limited to providing quarterly updates on its progress, commissioning (and publishing the results of) an independent annual financial audit, identifying and reporting on objective parameters of achievement of PDH, reserving at least 1/3 of the membership of the board of directors of PDH for donors and supporters, and adopting operating guidelines to prevent conflicts of interest in all its operations and eliminate all possibilities of employees, directors, and others enriching themselves as a result of affiliating and/or working with PDH.

The Strategy

The strategy of PDH represents the broad choices PDH makes on the way to achieving its mission and realizing its vision. Once again, the strategy is in three varieties:

A. With respect to Zambian individuals, the key strategy is to empower, encourage, mentor, and otherwise lend a hand so that individuals who interact with PDH are on a path of self-reliance. This strategy can best be summarized with the famous adage: If you give a man a fish he will eat for a day. If you teach a man to fish, he will eat for a lifetime.

B. With respect to Christian Missions, the main strategy is that each mission that is supported by PDH operates at least one sound business that provides opportunities for employment and training as well as serves to provide a continuing funding source for the parent mission.

C. With respect to donors and supporters the main strategy is to maintain close and continuing relationships with donors and supporters so that donors and supporters are always engaged, participate in the cultivation of ideas and new sources of support, and celebrate and enjoy the fruits of the PDH labors.

About Bent Nail Properties

Bent Nail Properties (“BNP”) will be another “feeder” enterprise into the PDH Foundation paradigm. BNP is envisioned to be a housing development in the capital city of Lusaka, consisting of 40 modern houses, a shared work space with 18 offices, and an indoor sports and physical fitness Centre. The object of the construction is to use the various finished components as rental properties to generate rental income to PDH Foundation (and through PDH ultimately to other mission organizations) and to the investors.

Bent Nail Properties will

• Provide employment opportunities to hundreds of construction workers for a period of approximately three years.

• Provide ample opportunities for laborers to acquire marketable skills.

• Provide continuing employment opportunities to personnel to operate and maintain the rental properties into the indefinite future.

• Afford an opportunity to operate a Christ-centered enterprise and introduce the Gospel as a living message to all involved.

• Deploy investor funds to create a new productive business. [Rental units + office space + sports facility].

• Generate earnings that will provide an opportunity for superior returns to investors and support PDH Foundation through direct contributions.

• Support PDH Foundation in carrying out its work as a mission-enabling organization.

• Once earnings begin to flow into BNP, afford investors the opportunity to recover their initial investment (via bond buy-backs) and retain all equity in the going concern as a net capital gain. Moreover, longer term, offer a share buy-back plan that will afford investors who want to unwind their investment completely the chance to sell their shares back to BNP. More on these points later.

• In all respects replicate the benefits previously identified under the UBH discussion.

The Mechanics

• Investor indicates the scope of his/her intention to participate in the BNP venture.

• Once US$4 million are subscribed, the investment window will close.

• The funds will be remitted to BNP within 30 days of the close of the window to subscribe.

• The funds will be used to

(a) buy the land (already acquired by an early investor who has contributed US$300,000 to do that), a parcel in the Northern part of Lusaka, the capital city, in an upscale and upcoming section of Lusaka),

(b) clear the land, add infrastructure, add roads within the compound,

(c) develop the architectural plans (already well underway),

(d) commence building as soon as possible, and (e) complete the construction within a three-year period.

• BNP will enter into a contract with SIMPEL Real Estate Ltd. to build the housing complex.

• Operate the rental units as a going concern.

• Shortly after Bent Nail Properties is fully funded, (1) re-constitute the board of directors so that directors are drawn 100% out of the investor group and (2) amend the bylaws to dedicate/donate at least 20% of BNP pre-tax earnings as a donation to PDH. Henceforth, the board of directors will govern all aspects of the operations of Bent Nail Properties Ltd. including setting the annual donation rate to PDH.

The Bond Features Are

• The bond will be a perpetual bond, meaning no fixed date of maturity. As a practical matter the term will be set for 50 years, the idea being these debentures will be retired within a few years after the Bent Nail Property rentals are fully occupied.

• The bond will accrue cumulative interest at the rate of 5% per annum, payable annually after the independent audit of the Bent Nail Properties for the just concluded calendar year has been completed.

• The bond will have a holding period of three or four years, in anticipation that the project will require three years to build and one additional year to become fully operational. That means no interest payments will be paid in cash during the holding period.

• During the holding period, the accrued interest will be added to the bond principal. That means the face value of the bond will increase to reflect the accumulated unpaid interest.

• The bonds will be callable, in whole or in part, at the option of the Bent Nail board of directors.

• A bond buy-back program is anticipated to be initiated as soon as earnings begin to be generated and are sufficient to pay the formula interest. It is expected that a bond buy-back will be offered annually after the holding period, using all earnings not used to pay income taxes and interest payments. The buy-back program will continue until all bonds have been redeemed.

The Financial Structure

The aim is to raise US$4 million in capital. The basic building block of the investment is a package of one bond and one share of stock. These would be separate securities even though they are acquired as a package. These securities will be registered with PACRA (The Zambian equivalent of the US SEC.) Each bond will have a face value of US$1,000, and each share of stock will have a par value of US$0.01. (Making for a total of 4,000 bonds and 4,000 shares.)

The stock features are

• No special features are anticipated to be associated with the common stock shares of Bent Nail.

• No dividends are anticipated to be paid, to avoid double taxation. Instead, the stock will simply appreciate in value as after-tax earnings are retained.

• Once all bonds have been redeemed, it is anticipated that an annual share buy-back program will be initiated and offered annually to enable those investors who wish to conclude their investment to be able to do so. For those investors who wish to retain their ownership interest, it is anticipated Bent Nail will operate into the indefinite future.

The end state of this investment can follow any of the following scenarios

A. Continue to operate into the indefinite future - supporting PDH, paying interest on the bonds, and seeing that excess earnings go to increase the value of the shares as unrealized capital gains.

B. Continue to operate as in A above, and use an annual bond buy-back program to use all excess earnings to retire the bonds, and once that is completed, continue to support PDH, and use the excess earnings to increase the value of the stock as additional unrealized capital gains.

C. Same as in scenario B, and after all bonds are redeemed, initiate an annual share buy-back program to enable the investors who wish to cash out to be able to do so.

D. In any of the above scenarios, PDH, as part of its programs to support other mission operations in becoming self-sustaining, may offer to buy individual units from Bent Nail, at prevailing market prices, and donate same to the mission organizations that meet its qualifying requirements.

Of course, the board of directors of Bent Nail will set the final parameters of all these options.

The Financial Blueprint - Forecasts and Projections

Assumptions. The following illustrations and representations, modeling the finances of this project for the first ten years of its existence, are built on the following assumptions:

• US$4 million is subscribed to complete the project. Bonds and shares are issued immediately. Funds will be paid to Bent Nail within 30 days from the end of the subscription period.

• Bond and stock packages will be issued.

• Building starts on January 1st 2024, and will require not more than three years to complete, no later than December 31, 2026

• The manager of the complex will be hired in 2024.

• Manager will develop all brochures, promotional materials, and the means for communicating the availability of the complex for occupancy beginning on January 1, 2025. Moreover, the manager will operate an administration office to handle the administrative elements of operating a rental complex.

• Project will be completed in four stages of one year’s duration each: ten homes at a time, with overlapping construction periods, and the first stage will all also include the construction of the office complex and sport facility so that they begin to generate rental revenue at the earliest possible time.

• A separate certificate of occupancy will be obtained for each set of ten homes. That will materialize via obtaining a separate building permit for each phase of the construction which, when completed will enable Bent Nail to begin renting those units while the rest of the building project continues.

• Renting units will commence on January 1, 2025, and full occupancy of each completed block of units is achieved within ten months after inception of the construction. • Advance reservations, leases, and earnest deposits will be encouraged and promoted prior to January 1, 2025.

• All rents will be dollarized, a common practice for high-end housing units in Lusaka.

• Rents will be set at 75% of the prevailing market rental rates for comparable units. This is one of the key strategic advantages that is realized by using a sister company to do the construction, and it is able to construct the compound at about 30% below the market rates. This has been demonstrated in all previous building projects. This is going to assure full occupancy into the indefinite future.

• Rents will increase at the rate of 5% per year. This is consistent with the history of rent increases in the Lusaka area that tend to run between 5 and 10% per year.

• First interest payments will be made in 2026 or 2027 depending on how rapidly the completed units are rented out.

• Thereafter, full interest is expected to be paid to the investors, including interest that had been accumulated during the holding period.

• First bond buy-back program will be announced to become effective on or about January 1, 2029. What this means is that investors will be asked to give an indication of interest for the portion of their bond holding they wish to redeem during this first round of buy-backs during January 2029. Offers to redeem bonds will be ranked in terms of size, from the smallest offering to the largest offering. Redemptions will be made starting with the smallest offering and continue until all available funds have been exhausted.

• The program will be offered annually thereafter until all bonds have been redeemed.

• From that point forward the investment will grow in terms of capital gains on the shares of stock.

Return on Investment - Four elements will contribute to the return on investment

A. Immediate capital appreciation. This aspect of the return on investment is the result of having SIMPEL do the construction. Historically it has been able to build structures at rates that are significantly below the market rates per square foot. Upon completion of the building of the complex, an immediate market appraisal of all the structures will be obtained and that appraisal will monetize the advantage of using SIMPEL to do the construction. Therefore, an immediate capital appreciation will materialize and will be reflected in an increased book value of the shares of stock. Based on extensive past experience, this can be expected to be an immediate major step up in the value of shares.

B. Continuing Payment of Bond Interest. This aspect of the return is set at 5% per annum, cumulative, from day 1 of committing funds to the project.

C. Annual Increase in Book Value Due to Accumulated Retained Earnings. What this means is that in a year when net earnings, after all expenses have been paid, all taxes have been paid, and all bond interest has been paid, any residual earnings will be retained serving to increase the book value of shares.

D. Continuing Capital Appreciation. Bent Nail is located in an up-and-coming section of Lusaka. Historically that section of the city has enjoyed continued appreciation in property values. There is no reason to expect that that will stop. This aspect of the return on investment will appear on the audited books of Bent Nail as we continue to get updates of market values, at regular intervals. In other words, this is the extension of the one-time step-up in value described in Paragraph A above.

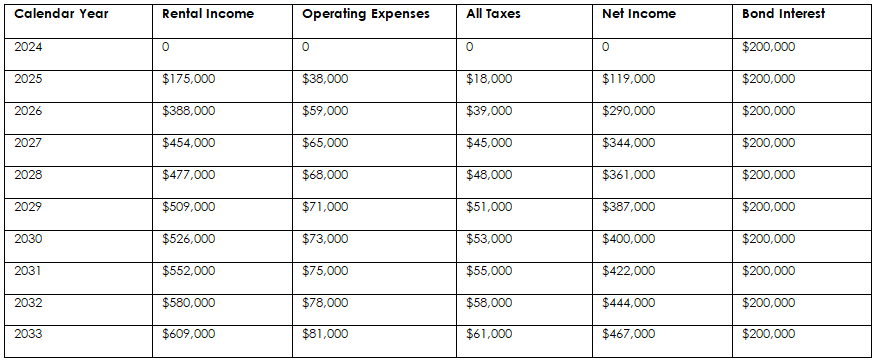

Forecast of the results of the rental activity of the complex. (Item B above) The table below shows the forecast of the results of the rental activity as coordinated with the building schedule:

The net income will be used to pay the bond interest, pay our committed contribution to PDH Foundation, and the rest goes toward bond/share buybacks and increased book value of shares.

About The Housing Estate

The Housing Estate will be situated along a Main Bypass Road, connecting the Great North Road (from Cape Town, South Africa to Cairo, Egypt) and the Great East Road (from Mozambique, East Africa to Namibia, West Africa). This is a main trade & access road in Africa, but it is situated within the center of the Northern Suburbs of Lusaka, the Capital City of ZAMBIA.

The housing estate is also ideally located near Zambia’s most prestigious golfing resort, called Ciêla Bonanza Golf Estate – www.cielaresort.com. It is also situated a stone’s throw away from Zambia’s premier Trident Primary School. The property is also a road frontage property to the ring road leading to the Kenneth Kaunda International Airport – the largest international airport in Zambia.

The booming market of the northern suburbs is taking over this area where our beautiful 40-unit housing estate with office and fitness center will be located. We will be the first in the northern suburb market to set up a state-of-the-art energy-efficient housing complex, with squash courts, racket ball courts, and shared workspace offices. We will be the first in the country to have an indoor junior Olympic swimming pool and a 24-foot rock-climbing wall.

The entire estate will be a biometric security gated community that provides a very high level of safety to the residents, making it ideal for expatriates to enjoy. The rental price will include both security surveillance and garden cleaning and landscaping services, which will keep our properties in excellent condition.

SIMPEL Real Estate Ltd. will construct the project at 30% below the market rate. We will then rent out our properties at 25% below the market rate, to enjoy a good return on our investments, whilst the properties are rented out with ease. We will benefit from long-term tenants, who will enjoy a competitive rental price.

During the construction of this project, we are projecting to create employment for over 800 Zambians over a two-and-a-half-year period. These local people will have the privilege to earn a well-balanced income, along with a properly cooked meal daily, as well as receive hands-on training and one-on-one mentoring, whilst being intentionally disciplined and empowered daily, working on these sites. The exact same can be said about the numerous permanent staff who will continue working on and in these properties for the foreseeable future. All this makes for a perfect illustration of a Business as a Mission model.

The Rental Units

The rental units will be individual houses with a secured backyard, but with a beautiful American-style front yard opening the entire property to make it look spacious and gracious, from the front of the properties. Each rental unit will be connected to a biodegradable sewerage system that will enable us to create gray water from wastewater to irrigate all the gardens from 12:00 am-04:00 am whilst all tenants are sleeping. All rental units also will be built with thermal insulation and solar inverted air conditioning units, allowing us to have, energy-efficient homes, and not only contribute to a better global environment but also set the standard of how it can be done in Zambia going forward. This will attract tenants that are supportive of taking care of the environment. Here are some examples of the floor plans of these rental units and what they will be rented out at for the public.